When Silicon Valley Meets the Pentagon: How Palmer Luckey Built America’s Next Defense Giant

Executive Summary

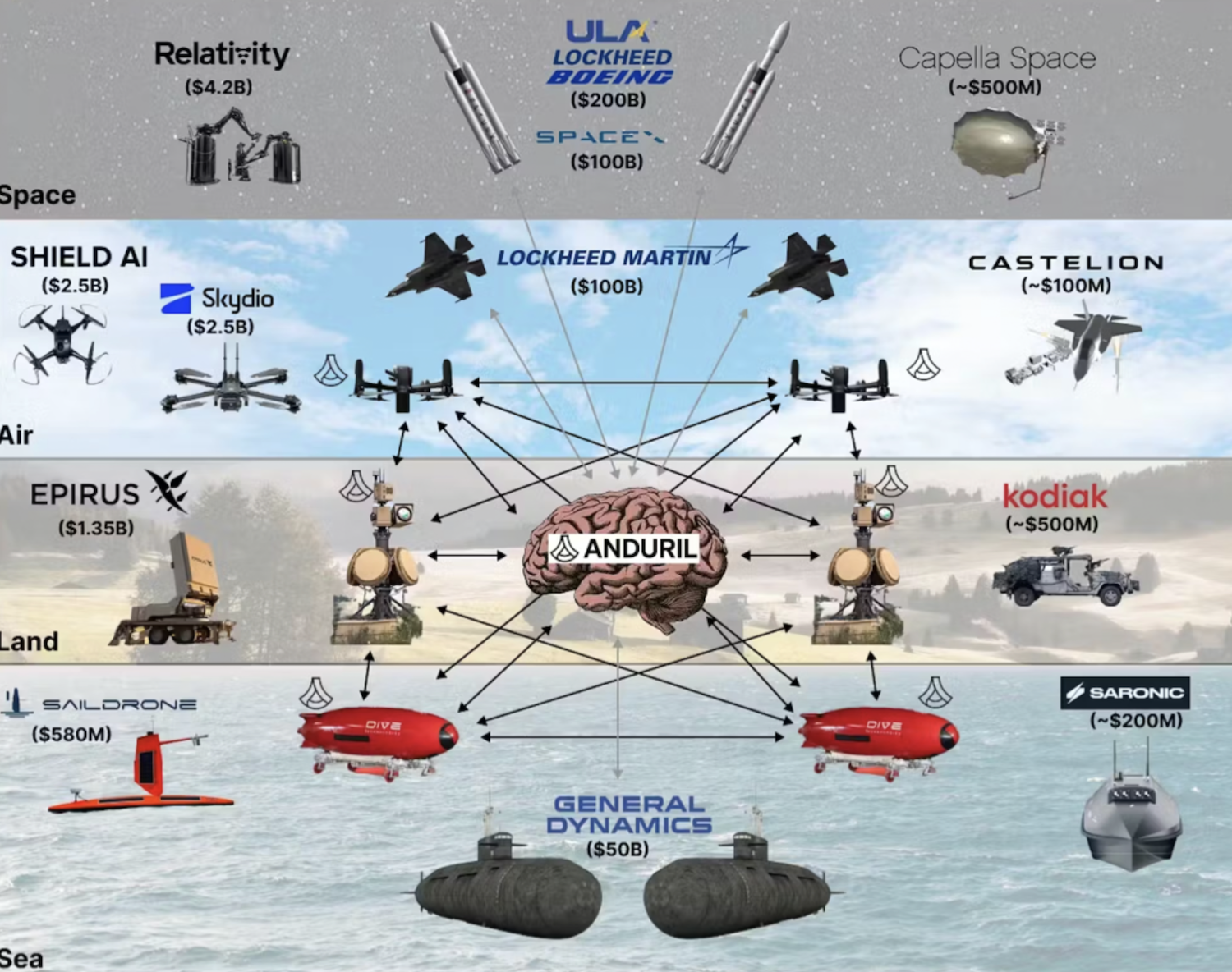

What is Anduril Industries? Anduril represents Silicon Valley’s boldest assault on the Pentagon’s trillion-dollar procurement machine, built by Oculus founder Palmer Luckey after his controversial exit from Facebook. Founded in 2017, this autonomous weapons and AI defense company has grown from startup to $30.5 billion valuation in just eight years, fundamentally challenging the “Big Five” defense contractors through venture-funded innovation cycles rather than traditional cost-plus government contracts.

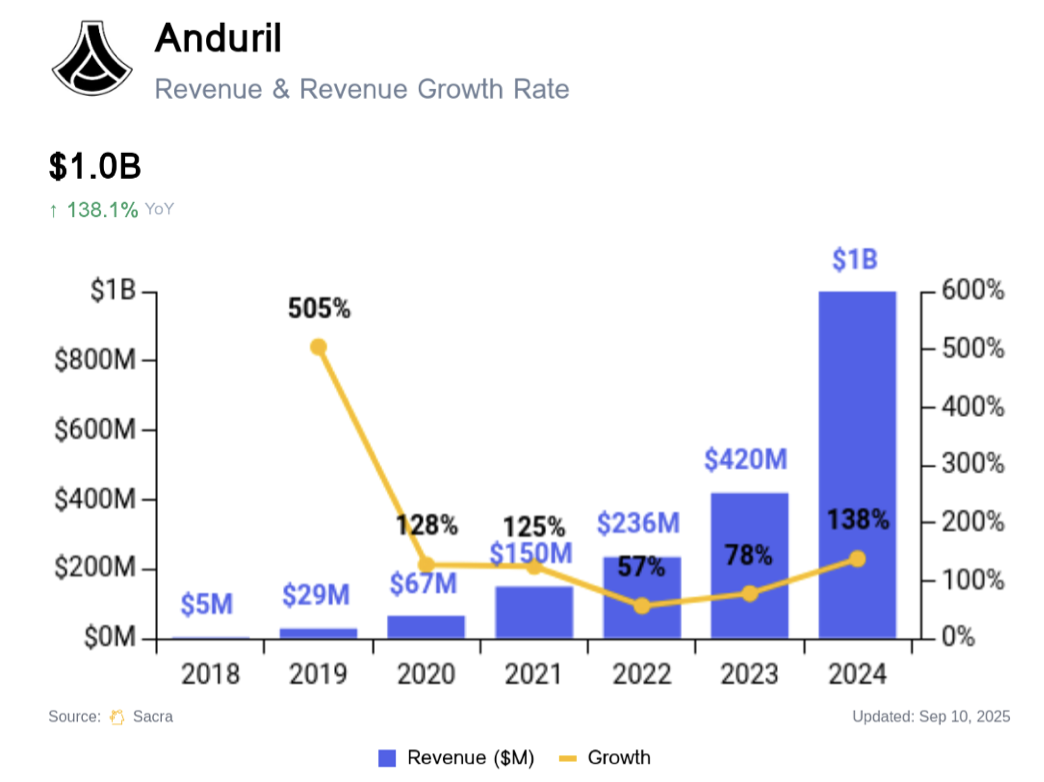

Anduril’s model proves that defense innovation can scale faster outside traditional procurement channels. By self-funding R&D and selling finished products rather than proposals, the company has compressed typical 10-15 year defense development cycles into 2-3 years, achieving $1 billion annual revenue while traditional contractors struggle with bureaucratic capture and technological stagnation.

Thanks to Anduril, the key determinant of market share has shifted from political connections to technological capability.

Historical Context: Defense Sector Transformation

Cold War Legacy and Modern Stagnation

America’s defense industrial base emerged from World War II mobilization, crystallizing during Cold War competition into what President Eisenhower warned against: a military-industrial complex optimized for sustained spending rather than technological superiority. By 2017, five prime contractors—Lockheed Martin, Boeing, Raytheon, General Dynamics, and Northrop Grumman—controlled 70% of Pentagon spending through relationships built over decades.

Traditional defense procurement follows predictable patterns: 5-7 year requirement development, 3-5 year competitive bidding, 10-15 year development cycles, and 20-30 year production runs. This model worked when adversaries faced similar technological constraints and military advantage came from superior manufacturing scale rather than algorithmic innovation.

Recent conflicts exposed critical gaps in this approach. Iraq and Afghanistan demonstrated asymmetric threats that traditional platforms couldn’t address, while China’s military modernization leveraged commercial technology advances that defense contractors couldn’t match. Commercial companies like Tesla developed more sophisticated autonomous systems than military contractors with hundred-billion-dollar budgets.

Software-defined warfare accelerated these trends. Modern military advantage increasingly depends on sensors, algorithms, and data processing rather than kinetic platforms. Yet defense contractors remained organized around hardware production, treating software as afterthought rather than core capability.

Why Now: Convergence Creates Opportunity

Several factors aligned to create unprecedented opportunities for defense sector disruption. Venture capital availability reached historic highs, with $3 billion invested in defense tech during 2024 alone. Commercial AI and autonomous systems achieved battlefield-relevant capabilities, while regulatory barriers began falling as Pentagon leadership recognized technological stagnation.

China’s military AI development created urgency around technological competition that transcended traditional partisan divides. Democratic and Republican administrations both prioritized maintaining American military technological advantage, creating bipartisan support for defense innovation regardless of contractor incumbency.

Most critically, a generation of Silicon Valley entrepreneurs gained sufficient wealth and experience to challenge entrenched contractors. Companies like SpaceX proved that commercial innovation cycles could outpace traditional defense development while achieving superior cost and performance metrics.

Founding Story: From VR Pioneer to Defense Visionary

Palmer Luckey’s Origin Arc

Palmer Luckey’s path to defense entrepreneurship began with virtual reality obsession in his Long Beach garage. Born in 1992, he was homeschooled and taking college courses at 14, driven by insatiable curiosity about immersive digital experiences. His sixth-generation VR prototype, dubbed Oculus Rift, caught attention from gaming industry legends like John Carmack, leading to successful Kickstarter campaign and eventual $2.3 billion Facebook acquisition in 2014.

At 22, Luckey became Silicon Valley’s youngest billionaire, but his Facebook tenure proved short-lived. In 2016, reports surfaced about his $10,000 donation to Nimble America, a pro-Trump organization known for creating inflammatory political memes. Facebook executives, already uncomfortable with Luckey’s outspoken political views, used this revelation to force his departure in March 2017.

“I’ve been through a lot,” Luckey later reflected. “Not a lot of people get to start a company, sell it for billions of dollars, and then get exiled from Silicon Valley.” Rather than retreat, he channeled this experience into fierce determination to prove his worth beyond VR.

Anduril’s Genesis: Lord of the Rings Meets Silicon Valley

Luckey’s transformation from VR entrepreneur to defense innovator began during a 2014 Founders Fund retreat on Sonora Island, British Columbia. There he met Trae Stephens, a former Palantir executive who shared frustration with Silicon Valley’s aversion to defense work. Despite billions in Pentagon spending, virtually no venture-backed companies pursued defense contracts beyond Palantir and SpaceX.

Stephens found this gap “ridiculous” given government spending power and urgent national security needs. He actively sought defense startups for Founders Fund to support, but Silicon Valley’s cultural hostility to military applications made recruitment difficult. Luckey’s post-Facebook situation created perfect alignment: proven entrepreneurial ability, significant personal wealth, and burning desire to prove himself again.

In June 2017, just months after leaving Facebook, Luckey incorporated Anduril Industries alongside four co-founders: Stephens (Founders Fund partner), Matt Grimm (Palantir veteran), Brian Schimpf (former Palantir engineering director turned CEO), and Joseph Chen (early Oculus hire). They named their venture after Aragorn’s sword from Tolkien’s mythology—Andúril meaning “Flame of the West” in Elvish.

Product Portfolio: Redefining Military Capability

Lattice: Software-Defined Battlefield

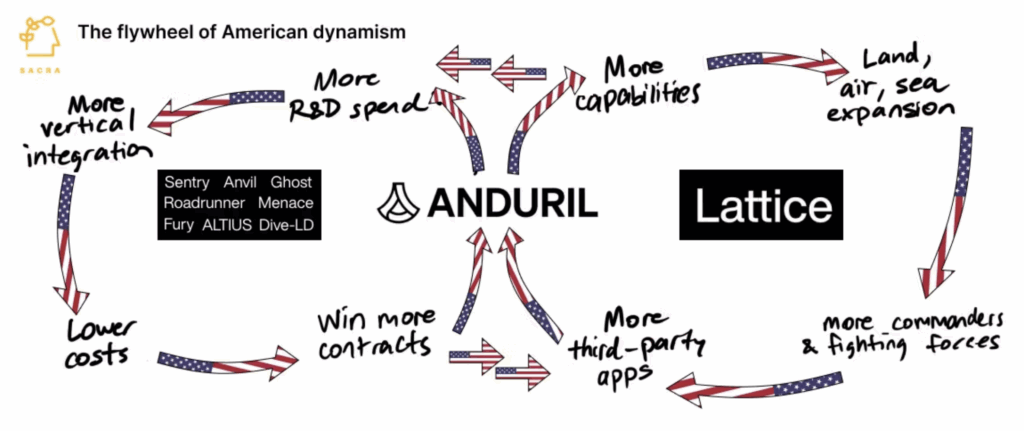

Anduril’s core innovation centers on Lattice, an AI-powered command and control platform that transforms military operations through real-time situational awareness.

Lattice processes data from satellites, drones, ground sensors, and human intelligence to create dynamic 3D battlefield maps updated in real-time. Machine learning algorithms identify threats, predict enemy movements, and recommend optimal responses while enabling autonomous system coordination without human micromanagement.

Ghost: Autonomous Air Superiority

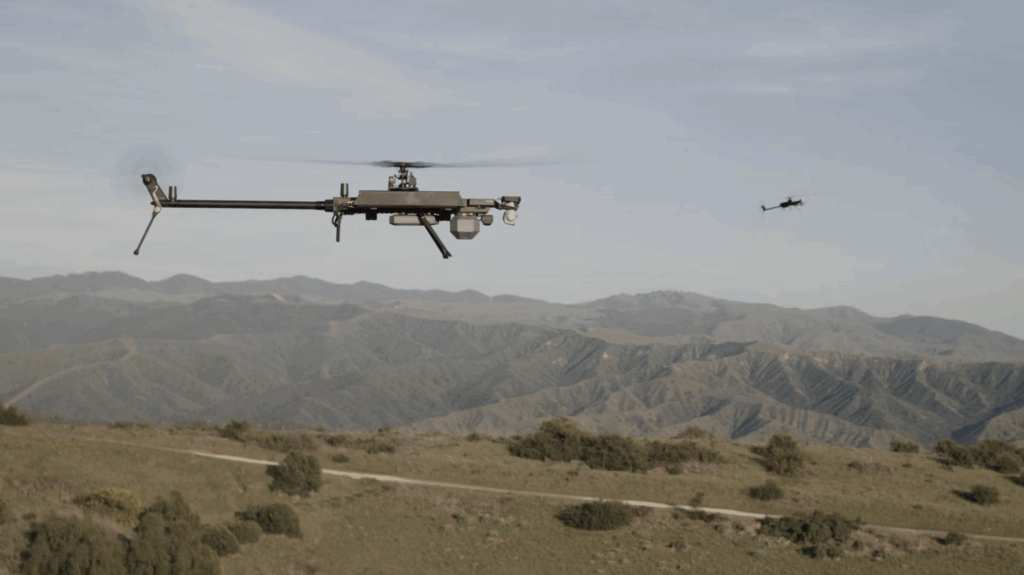

Ghost drones represent Anduril’s flagship hardware platform, combining advanced autonomy with modular payload architecture. Unlike traditional military drones requiring constant human control, Ghost operates autonomously for extended periods using onboard AI processing originally developed for self-driving cars.

Multiple Ghost variants serve different mission requirements.

-

Ghost 4 provides 75-minute flight time with 25-kilometer range for tactical reconnaissance.

-

Ghost X offers enhanced endurance for sustained surveillance missions.

Each platform features five modular payload bays enabling rapid reconfiguration for different missions without hardware redesign.

Ghost’s autonomous capabilities enable “swarm” operations where multiple units coordinate without central control, sharing data and adapting to changing battlefield conditions in real-time.

U.S. Army selected Ghost X in September 2024 for Company-Level Small UAS Directed Requirement.

Dive and Submarine Systems: Undersea Autonomy

Anduril’s maritime portfolio includes Ghost Shark autonomous submarines developed for Royal Australian Navy. These Extra Large Autonomous Undersea Vehicles (XL-AUVs) operate independently for weeks without surface communication, conducting reconnaissance and engagement missions in contested waters.

Dive-LD platforms deploy and recover smaller underwater vehicles, extending operational range while providing distributed sensing capabilities. Advanced autonomy enables operations in GPS-denied environments using inertial navigation and environmental mapping.

Prototype testing begun in 2024 demonstrated significant undersea endurance with successful navigation and mission completion. Full-scale production systems expected by mid-2025 will provide allied navies with unprecedented undersea autonomous capabilities.

Recent Technological Breakthroughs

Roadrunner: High-Speed Interceptor Innovation

Anduril’s newest addition, Roadrunner, represents breakthrough in interceptor design through novel twin-turbojet architecture. Unlike traditional single-use interceptors, Roadrunner can return to base for reuse if not expended during mission, dramatically reducing operational costs while maintaining engagement effectiveness.

Roadrunner’s high-speed capabilities enable interception of advanced cruise missiles, hypersonic glide vehicles, and other time-sensitive threats. Modular design allows mission-specific configuration with different warhead and sensor packages depending on threat requirements.

Meta Partnership: Augmented Reality Military Applications

Anduril’s recent partnership with Meta represents significant expansion into augmented reality military applications. Following Army reassignment of Microsoft’s troubled IVAS headset program, Anduril and Meta will develop next-generation combat goggles integrating Lattice situational awareness with AR visualization. Potential contract value reaches $21.9 billion over next decade, representing one of largest military technology programs currently active.

Financial Performance and Strategic Positioning

Revenue Growth and Market Expansion

Anduril’s financial trajectory demonstrates sustained hypergrowth rare among defense contractors. Revenue doubled from $500 million to $1 billion during 2024, driven by contract wins across multiple service branches and international partners. Total contract value secured exceeds $1.5 billion, providing strong foundation for continued expansion.

Major contract victories include:

-

$967 million Advanced Battle Management Systems award.

-

$1 billion Special Operations Command counter-drone program.

-

$250 million Department of Defense interceptor contrac.

International expansion accelerated through Royal Australian Navy submarine program ($100 million) and Royal Navy Ghost drone deployments. Allied partnerships provide both revenue diversification and strategic validation of Anduril’s technological approaches.

Valuation Trajectory and Investment Dynamics

Valuation progression from $4.6 billion (2021) to $14 billion (2024) to $30.5 billion (2025) demonstrates consistent investor appetite despite typical defense sector skepticism. Oversubscription by 8x indicates continued demand for defense technology exposure among sophisticated investors. At $30.5 billion valuation, Anduril approaches half the market capitalization of established defense giants like Northrop Grumman and General Dynamics.

Competitive Positioning Against Legacy Contractors

Anduril’s competitive advantages stem from organizational structure optimized for rapid innovation rather than sustained political relationships. While legacy contractors average 10-15 year development cycles, Anduril delivers operational systems within 2-3 years through venture-funded R&D approaches.

Technical differentiation centers on software-first architecture enabling continuous capability updates through algorithmic improvements rather than hardware modifications. This approach provides sustainable competitive advantages as military requirements evolve faster than traditional procurement cycles accommodate.

Manufacturing Strategy: Arsenal-1 and Industrial Scale

Ohio Manufacturing Hub Development

Anduril’s $1 billion Arsenal-1 facility in Pickaway County, Ohio represents unprecedented private investment in defense manufacturing infrastructure. This 5-million-square-foot complex will mass-produce autonomous systems including Ghost drones, Arsenal interceptors, and Roadrunner vehicles using commercial manufacturing techniques adapted for military requirements.

Arsenal-1’s design emphasizes flexibility and rapid reconfiguration rather than single-product optimization typical of traditional defense manufacturing. Modular production lines enable quick transitions between different systems as military requirements evolve, maximizing facility utilization while minimizing retooling costs.

Future Direction: Scaling Defense Transformation

Technological Roadmap and R&D Priorities

Anduril’s research and development priorities center on advancing autonomous systems capabilities across multiple domains. Machine learning algorithm improvements focus on enhanced situational awareness, predictive threat analysis, and multi-platform coordination without human oversight.

Next-generation Lattice development emphasizes integration across services and allied partners, creating unified operating picture spanning global military operations. Interoperability standards enable seamless data sharing while maintaining security protocols necessary for classified information handling.

Economic Impact and Industry Transformation

Defense Industrial Base Modernization

Anduril’s success catalyzes broader defense sector transformation as investors recognize opportunities in military technology innovation. Traditional metrics focused on political relationships and cost-plus contracting give way to technical capabilities and operational effectiveness as primary competitive advantages.

Venture capital investment in defense technology increased 33% year-over-year during 2024, with total sector investment reaching $3 billion.

Congressional recognition of defense innovation importance drives policy changes favoring competitive procurement over traditional relationship-based contracting. New authorities enable rapid prototype development and deployment cycles that favor commercially-funded innovation over traditional requirement-driven approaches.

National Security Implications

-

Successful defense industrial base modernization directly impacts American military capabilities and strategic positioning. Software-defined warfare requires continuous innovation cycles that traditional contractors cannot match, making ventures like Anduril essential for maintaining technological superiority.

-

Autonomous systems development provides force multiplication capabilities that address military recruitment challenges while reducing personnel risk in contested environments. These capabilities prove particularly valuable as adversaries develop anti-access strategies designed to exploit traditional platform vulnerabilities.

Conclusion: Reinventing American Defense

Anduril Industries represents more than successful startup story—it demonstrates path forward for American defense industrial base modernization essential for maintaining global military superiority. Palmer Luckey’s transformation from VR entrepreneur to defense innovator illustrates how Silicon Valley capabilities can address national security challenges traditional contractors struggle to solve.

Eight years from founding to $30.5 billion valuation proves that defense sector transformation remains possible despite institutional inertia and political complexity. Success requires combining technical excellence with sophisticated understanding of military requirements, regulatory compliance, and political dynamics that determine defense acquisition outcomes.

Contributors: Michael C. Chase, Sophia J. Wang, Ira Winder