When Trillion-Dollar Training Runs Meet Manhattan Project Economics

Executive Summary

What drives artificial general intelligence economics? We’re witnessing humanity’s largest coordinated industrial effort, demanding unprecedented capital allocation, energy infrastructure, and technological convergence. Current projections indicate cumulative investment reaching $1-10 trillion through 2030—rivaling World War II’s economic mobilization when adjusted for modern GDP. Exponential scaling from GPT-4’s ~$100 million training cost to projected systems requiring $100+ billion demonstrates resource intensity that fundamentally reshapes global economic priorities.

Key Finding: Current developments exhibit striking parallels to historical industrial mobilizations, with similar patterns of exponential resource scaling, supply chain transformation, and winner-takes-all competitive dynamics. Success requires not just technical breakthroughs, but coordinated mobilization of capital markets, energy infrastructure, and semiconductor manufacturing at scales previously reserved for wartime economies.

Bottom Line: Building artificial general intelligence creates a new form of economic mobilization determining technological supremacy for the remainder of this century, with profound implications for national competitiveness, resource allocation, and global power structures.

Historical Mobilization Patterns

America’s World War II mobilization provides our closest historical parallel. Between 1940-1945, defense spending increased from $1.7 billion to $81.3 billion annually—a 47x multiplication transforming the entire industrial base. Adjusted for modern scale, this mobilization consumed approximately $4.2 trillion in 2025 dollars, representing 37% of peak wartime GDP.

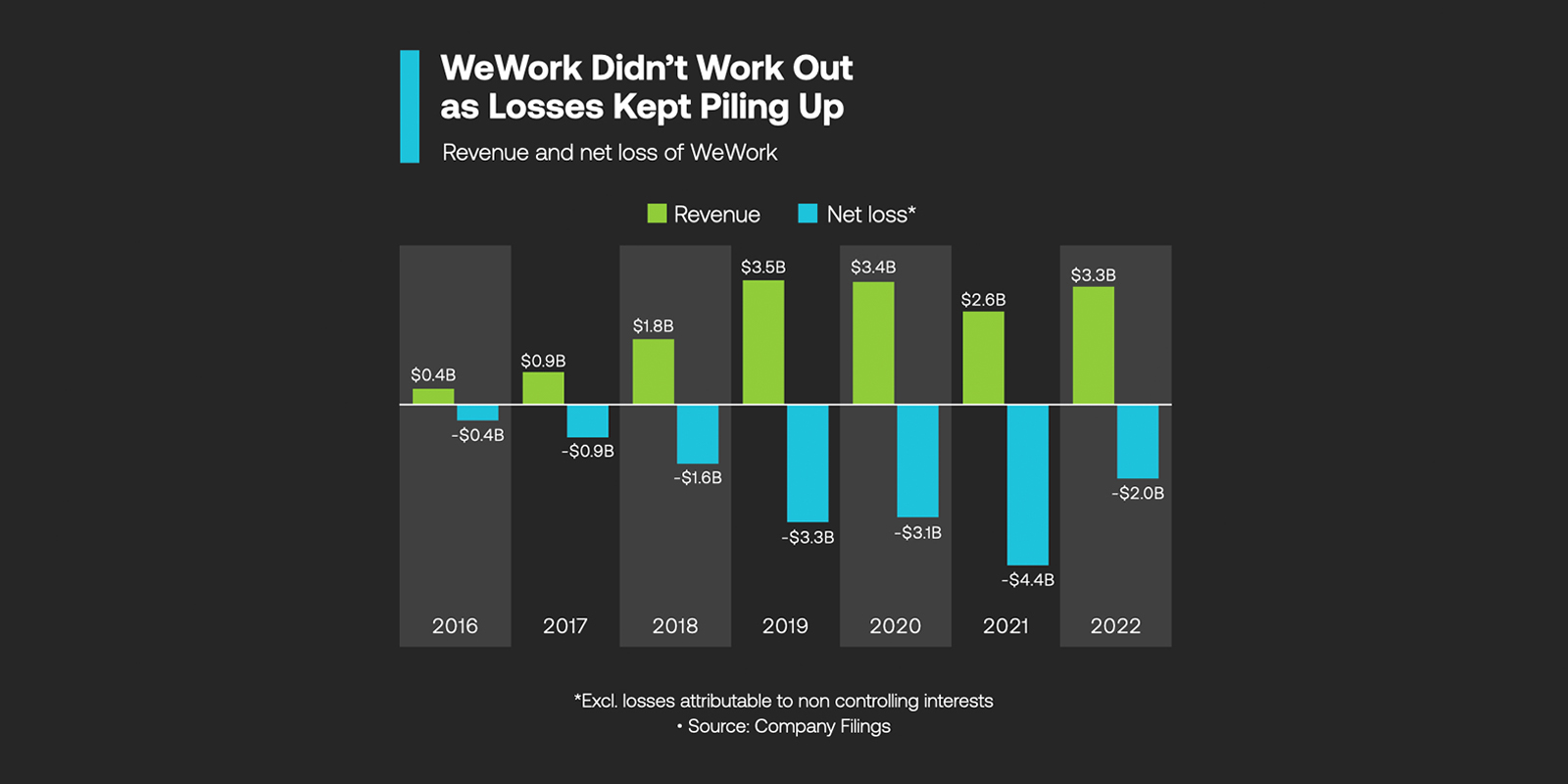

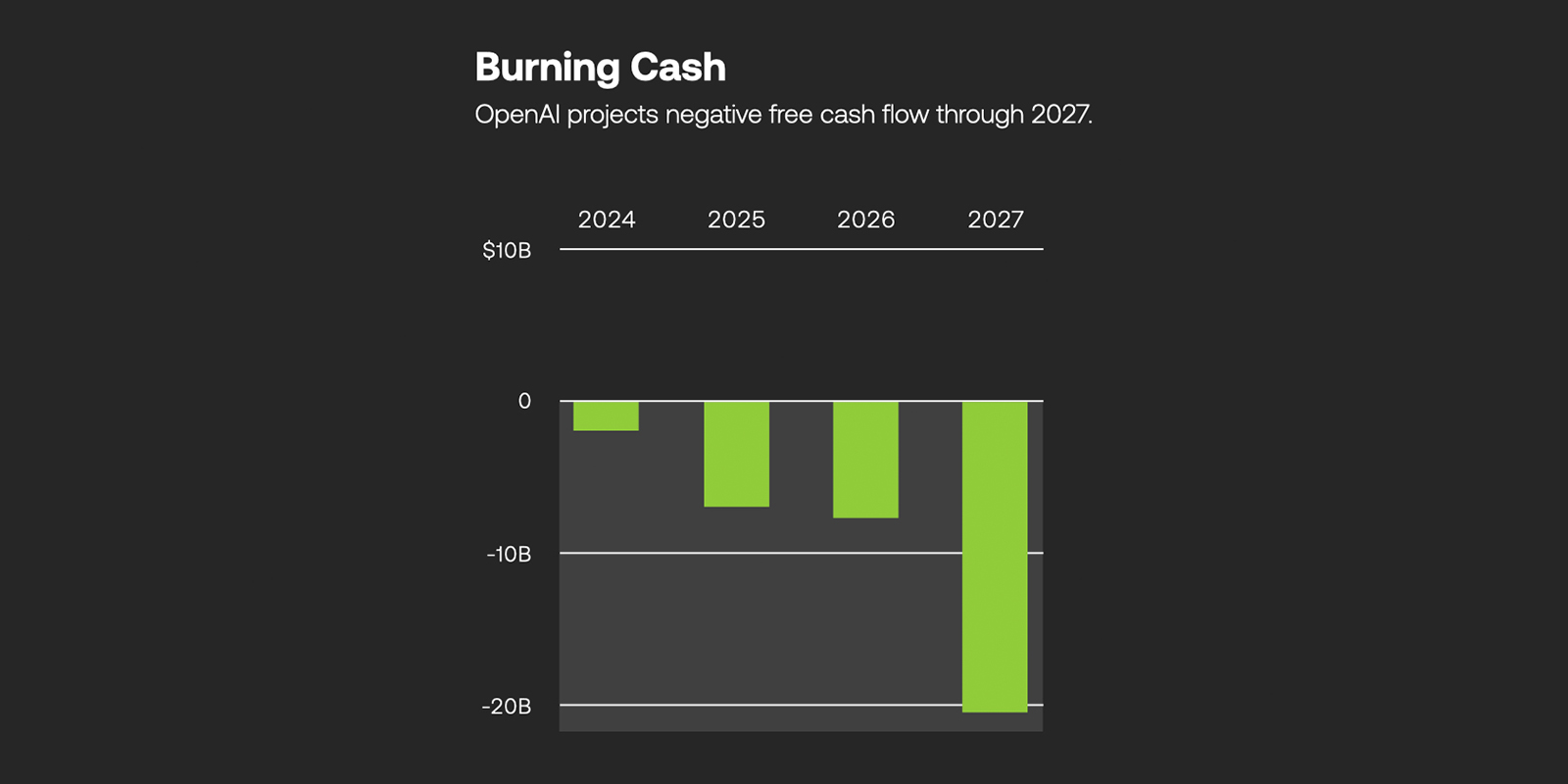

WeWork’s trajectory from 2016-2022 illustrates what happens when exponential growth assumptions meet economic reality. Revenue growth from $0.4B to $3.3B couldn’t offset mounting losses that peaked at $4.4B annually—a cautionary tale for AI companies burning cash at unprecedented rates while chasing transformative capabilities.

Current artificial intelligence scaling mirrors these exponential patterns. OpenAI’s progression from GPT-3 ($4.6 million estimated) to GPT-4 (~$100 million) to projected future models ($1+ billion) represents compound annual growth exceeding 300% in computational requirements. Extending this trajectory suggests individual training runs costing $100-500 billion by 2030, assuming continued scaling laws and current efficiency curves.

Semiconductor manufacturing reveals additional mobilization dynamics. TSMC’s advanced node production has become as strategically critical as wartime steel production, with similar supply chain vulnerabilities and geopolitical implications. Today’s $500+ billion global semiconductor expansion represents industrial coordination unseen since Interstate Highway construction, driven primarily by AI compute demands.

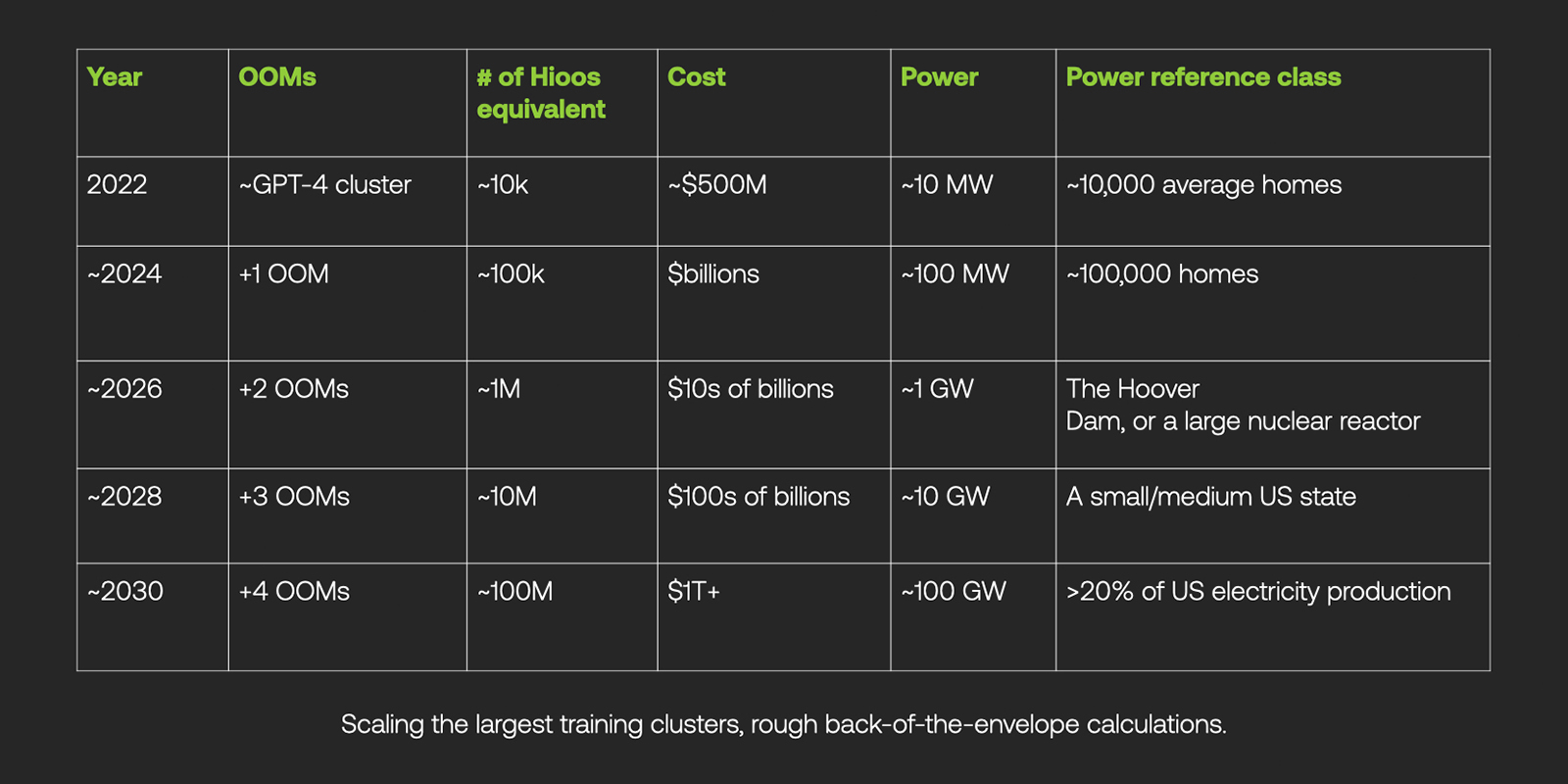

Energy infrastructure demands approach wartime mobilization scales. Current hyperscale facilities consume 10-50 MW continuously, with next-generation AI centers requiring 100-500 MW each. Cumulative power requirements for achieving artificial general intelligence—conservatively 10-20 GW of dedicated capacity—would demand building 15-30 large nuclear plants exclusively for AI computation.

Scaling from GPT-4’s ~10k H100-equivalent chips to million-chip clusters by 2026 represents exponential resource mobilization. Costs escalate from hundreds of millions to tens of billions, while power requirements jump from ~10 MW to 1 GW—equivalent to large nuclear reactors dedicated solely to training individual AI models.

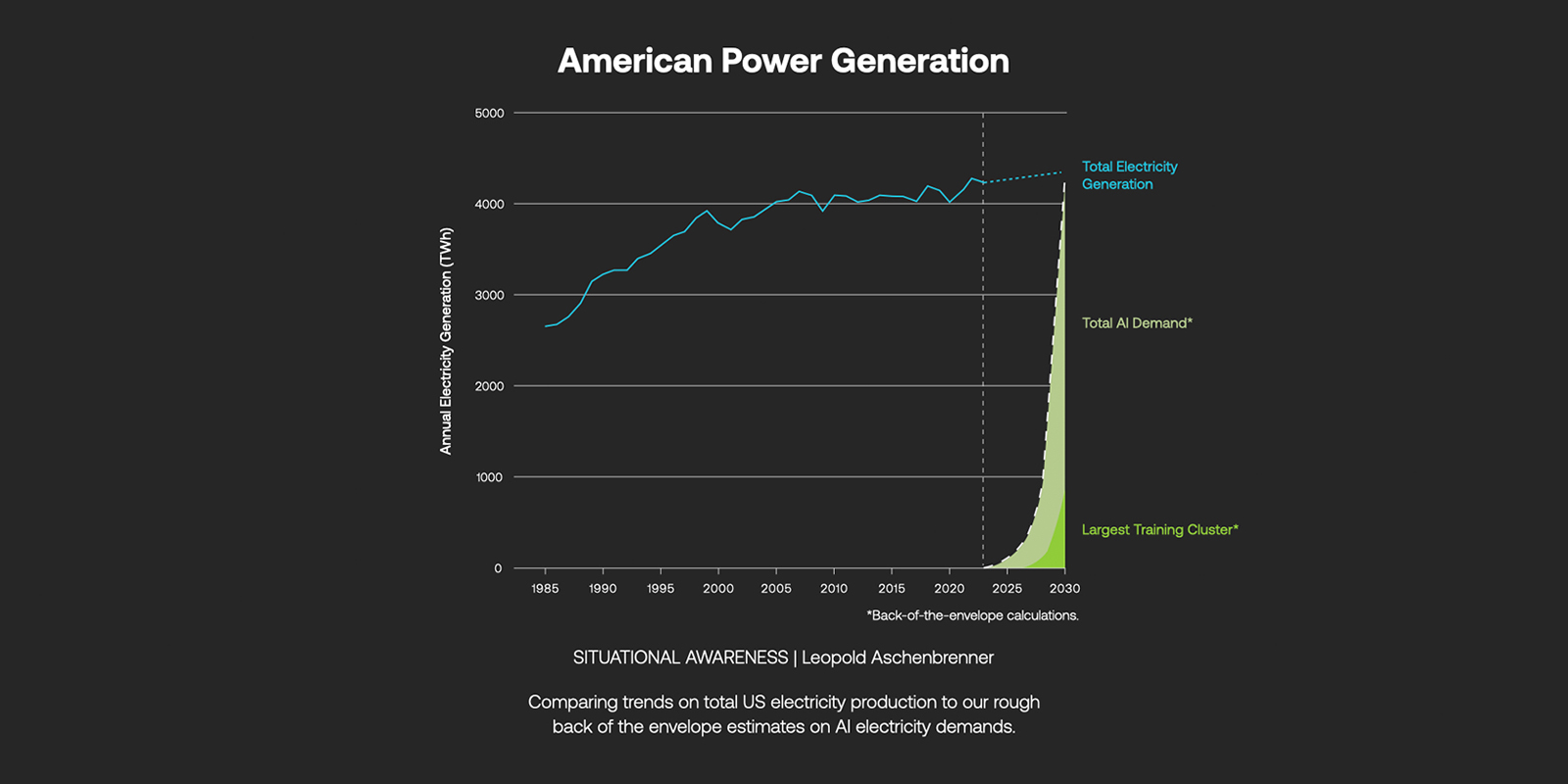

Leopold Aschenbrenner’s analysis reveals even more dramatic projections. By 2030, largest training clusters could consume ~100 GW—over 20% of current US electricity production. Training runs lasting months cannot tolerate power interruptions, requiring redundant generation and geographical distribution fundamentally altering data center economics. Infrastructure investments of $200-400 billion globally through 2030 represent coordination comparable to rural electrification programs.

Semiconductor fabrication creates additional bottlenecks. Advanced AI chips require cutting-edge processes available only at handful of facilities globally. Current 6-month lead times for high-end accelerators, extending to 12+ months for custom silicon, create supply constraints reminiscent of wartime materials allocation. Scarcity drives vertical integration among leading AI companies, with firms increasingly acquiring or partnering with manufacturers to secure supply.

Financial Architecture Revolution

Artificial intelligence development has fundamentally transformed private equity markets. Traditional venture rounds of $10-100 million prove insufficient for companies scaling toward general intelligence. OpenAI’s $13 billion Microsoft partnership, Anthropic’s $4+ billion from Amazon and Google, and similar mega-rounds represent investment categories historically reserved for leveraged buyouts or infrastructure projects.

Capital intensity creates natural selection favoring large technology corporations and sovereign wealth funds over traditional venture investors. Required $100+ billion for comprehensive development approaches annual capacity of entire venture capital industries, concentrating efforts among well-capitalized entities.

Market structure exhibits defense contracting characteristics during wartime mobilization—small number of prime contractors (OpenAI, Anthropic, DeepMind, Meta) supported by extensive supplier networks. Barriers to entry require simultaneously breakthrough research talent, massive compute infrastructure, and billion-dollar funding rounds, creating oligopolistic dynamics similar to aerospace and defense.

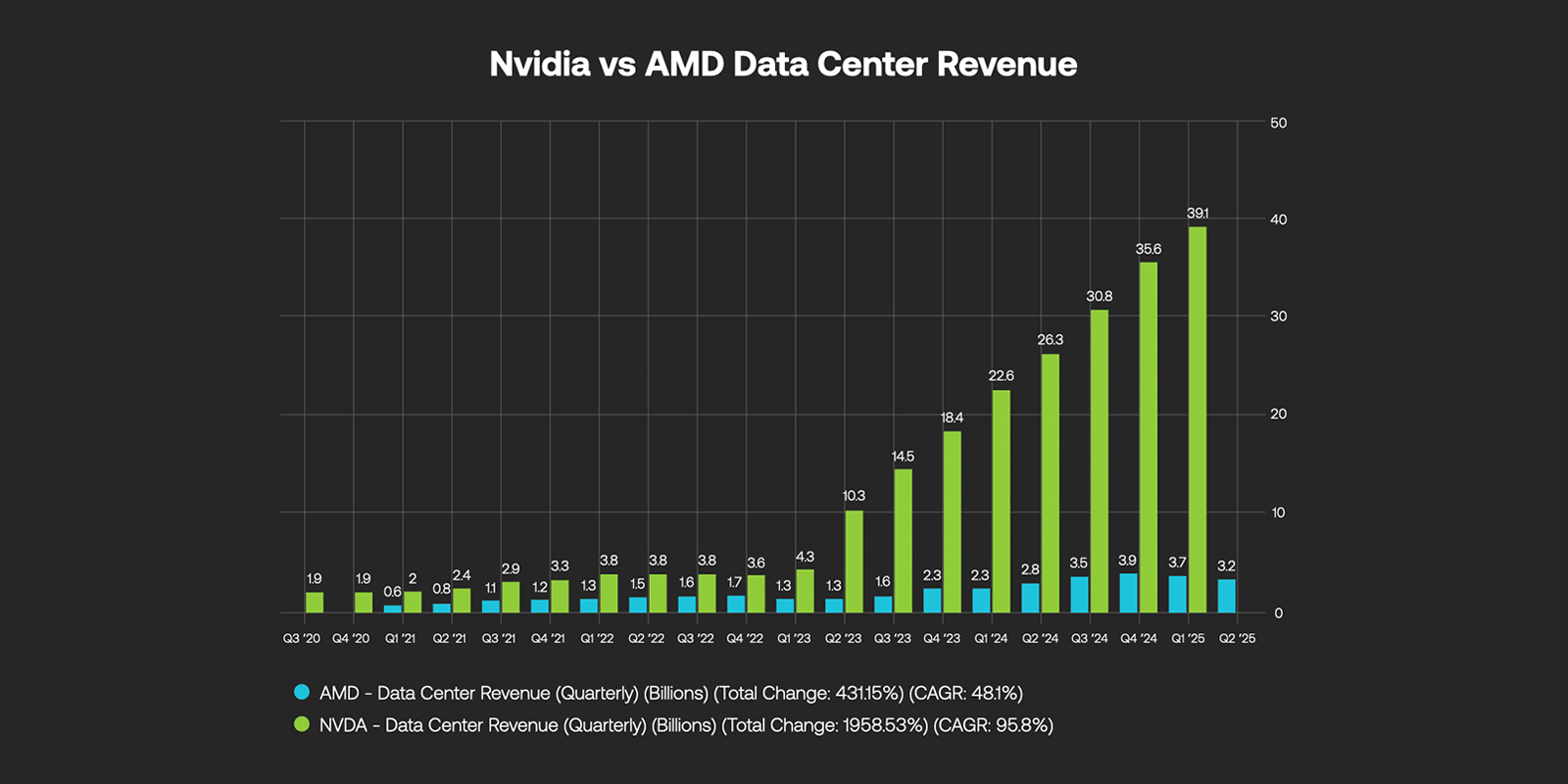

Public equity markets price artificial general intelligence development potential into technology valuations, creating market capitalizations reflecting expected future revenues rather than current fundamentals. NVIDIA’s trillion-dollar valuation at 25x revenue incorporates assumptions about continued AI scaling dwarfing historical technology adoption curves.

OpenAI dominates the AI revenue landscape, capturing roughly 80% of the $18.5 billion total across AI-native companies. Anthropic represents the primary challenger, while 16 other startups compete for remaining market share. Top two firms control 88% of revenues, demonstrating winner-takes-all dynamics already emerging in early-stage AI markets.

Disconnect between current AI revenues ($18.5 billion globally across AI-native companies) and cumulative private investment ($100+ billion since 2020) indicates markets pricing artificial general intelligence as winner-takes-all competition with extreme outcome distributions. This mirrors internet bubble dynamics but with fundamentally stronger technical foundations and clearer paths to monopolistic positions.

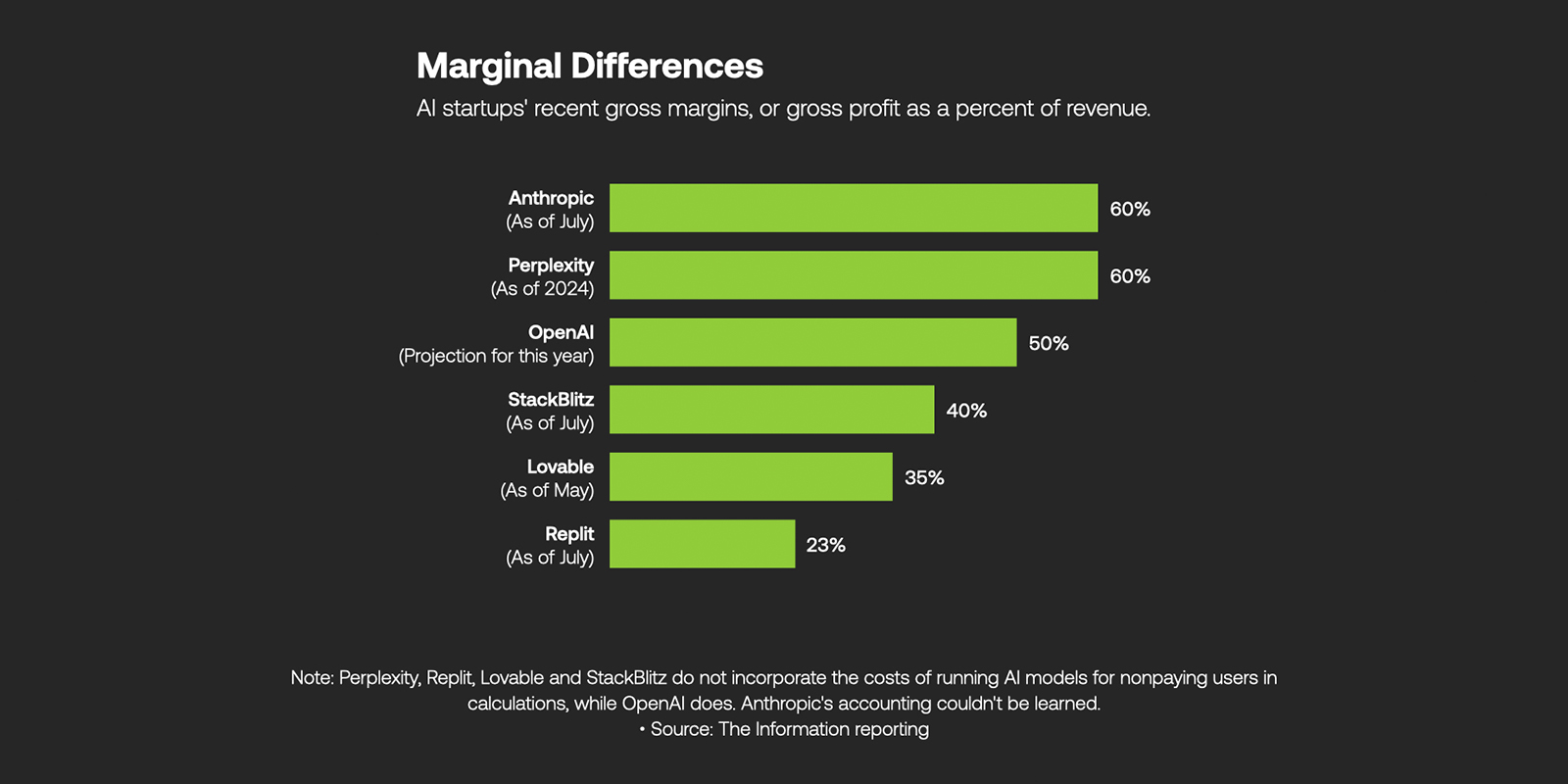

Gross margin analysis reveals stark differences in AI business models. Anthropic and Perplexity achieve 60% gross margins by not incorporating model inference costs for free users, while OpenAI projects 50% margins despite including these costs. Replit’s 23% margin reflects different cost structures, highlighting varied approaches to AI monetization and operational efficiency.

Sovereign wealth fund participation introduces geopolitical considerations typically absent from technology investments. Saudi Arabia’s $40+ billion AI fund, UAE’s strategic investments, and similar national initiatives position artificial general intelligence development as infrastructure competition between nation-states rather than purely commercial ventures.

Exponential Compute Economics

Current scaling laws suggest achieving human-level performance across cognitive domains requires training runs 100-1000x larger than GPT-4, translating to computational requirements of 10^26-10^27 floating-point operations. At current efficiency and hardware costs, this implies training costs of $10-100 billion per experiment, with successful development potentially requiring multiple attempts.

Economic implications fundamentally alter R&D structures. Traditional technology development follows relatively linear cost patterns with incremental improvements. Artificial intelligence exhibits exponential cost scaling for potentially discontinuous capability improvements, creating investment risk profiles more similar to pharmaceutical development or aerospace programs than software engineering.

Compute infrastructure required for training exceeds capacity of any single facility currently operating. Distributed training across multiple data centers introduces networking and synchronization challenges driving additional infrastructure investment. Geographic distribution creates new considerations for data sovereignty, latency optimization, and operational security.

Semiconductor industry has realigned around AI compute requirements, with traditional CPU manufacturers pivoting to accelerator development and new entrants challenging established players. Current GPU shortage extends delivery times to 6-12 months for enterprise hardware, demonstrating supply-demand imbalances characteristic of wartime materials allocation.

Economic impact extends beyond immediate hardware costs to entire semiconductor ecosystem. Advanced packaging, high-bandwidth memory, and specialized cooling become critical components, creating new bottlenecks and investment opportunities. Cumulative capital expenditure for AI-optimized semiconductor capacity, estimated at $200+ billion through 2030, represents coordinated expansion comparable to 4G wireless infrastructure build-out.

NVIDIA’s data center revenue dominance illustrates semiconductor industry realignment around AI. Growing from $1.9B quarterly in Q3 2020 to $39.1B in Q1 2025 represents 1958% total growth and 95.8% CAGR. AMD’s data center segment shows strong growth but remains dwarfed by NVIDIA’s scale, highlighting winner-takes-all dynamics in AI chip markets.

Custom silicon development introduces additional economic dynamics. Companies investing $1-10 billion in proprietary architectures (Google’s TPUs, Tesla’s AI chips, Apple’s neural engines) create competitive moats through vertical integration. This trend toward custom silicon mirrors aerospace industry reliance on proprietary technology for competitive advantage.

Winner-Takes-All Dynamics

Artificial general intelligence development exhibits economies of scale favoring concentrated market structures. Fixed costs of training large models, developing safety frameworks, and maintaining research teams create barriers increasing with each capability generation. Once achieved, systems deploy at marginal costs approaching zero, creating natural monopoly characteristics.

Intellectual property landscape introduces additional competitive considerations. Unlike traditional software with incremental improvements, breakthroughs may create discontinuous advantages proving difficult to reverse-engineer or replicate. This favors first-mover advantages and aggressive R&D investment over incremental approaches.

Data requirements create another dimension of competitive advantage. Companies with access to large, high-quality datasets (web crawls, user interactions, proprietary content) maintain advantages compounding over time. Legal and economic complexities of data licensing introduce new forms of strategic asset accumulation.

Development has become explicitly recognized as national security priority, with export controls on advanced semiconductors and technology transfer restrictions. Resulting fragmentation creates parallel innovation ecosystems with different technical approaches, regulatory frameworks, and competitive dynamics.

Economic implications of technological decoupling extend beyond AI companies to entire technology stacks. Semiconductor manufacturers, cloud providers, and research institutions navigate increasingly complex compliance requirements adding costs and reducing efficiency. Duplicated R&D investment across competing national programs may slow progress while increasing aggregate costs.

China’s estimated $1.4 trillion AI development plan through 2030 represents coordinated technology investment exceeding Apollo program and Manhattan Project combined when adjusted for economic scale. State-directed investment creates competitive pressures for market-based approaches in Western countries, potentially requiring policy responses altering traditional free-market development.

Economic Disruption and Transformation

Economic disruption from deployment may exceed previous technological revolutions due to potential scope across cognitive rather than purely physical tasks. Historical precedent suggests technology creates new employment categories while displacing others, but artificial general intelligence’s broad capabilities create uncertainty about which human activities remain economically viable.

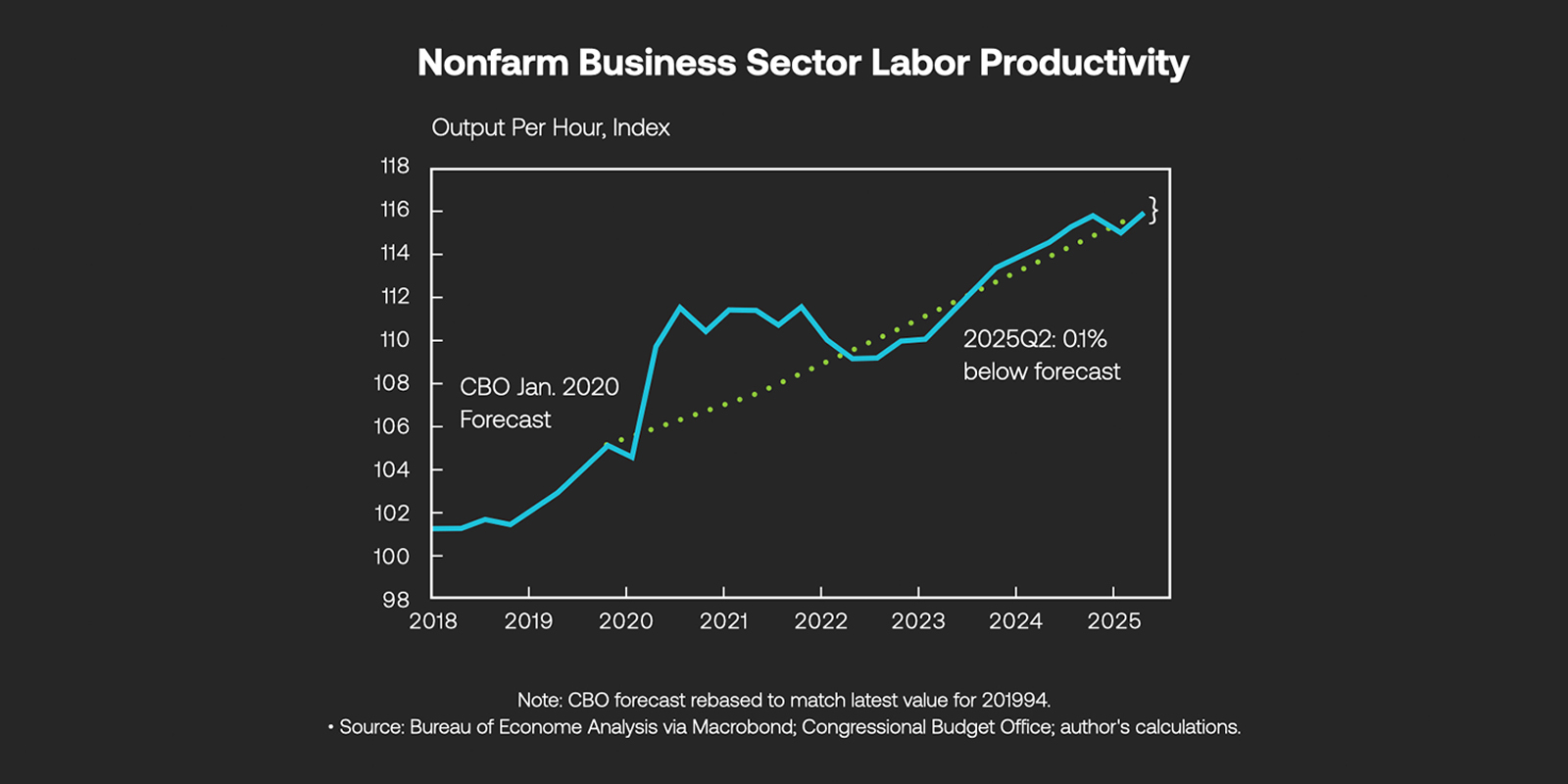

Nonfarm business sector productivity reveals both promise and limitations of current AI deployment. After steady growth from 2018-2025, productivity gains track closely with CBO forecasts, showing only 0.1% deviation by Q2 2025. While AI contributes to maintaining growth trajectories, transformative productivity acceleration from deployment remains unrealized, suggesting current systems haven’t yet achieved economy-wide transformation.

Transition costs for labor market adjustment could reach trillions globally, including retraining programs, social safety net expansion, and economic support during transition periods. These costs, while ultimately offset by productivity gains, create near-term fiscal pressures requiring coordinated policy responses similar to wartime economic mobilization.

Concentration of capabilities among small number of companies raises questions about economic rent distribution and market power. Unlike previous technological platforms, systems may capture value across multiple industries simultaneously, creating unprecedented concentration of economic control.

Energy requirements for widespread deployment extend beyond training to inference and operation. Conservative estimates suggest ubiquitous deployment could increase global electricity consumption by 5-15%, requiring massive expansion of generation capacity and grid infrastructure.

Historical context reveals potential for technology to fundamentally alter electricity demand patterns. While US power generation has remained relatively stable around 4,000 TWh annually since 2005, AI training clusters could create unprecedented spikes. Single large training runs by 2030 may consume more electricity than entire states, fundamentally reshaping American power generation priorities.

Geographic concentration of AI compute facilities creates new patterns of economic development, with regions offering cheap electricity and favorable regulations attracting disproportionate investment. This mirrors historical patterns of industrial clustering around natural resources or transportation infrastructure.

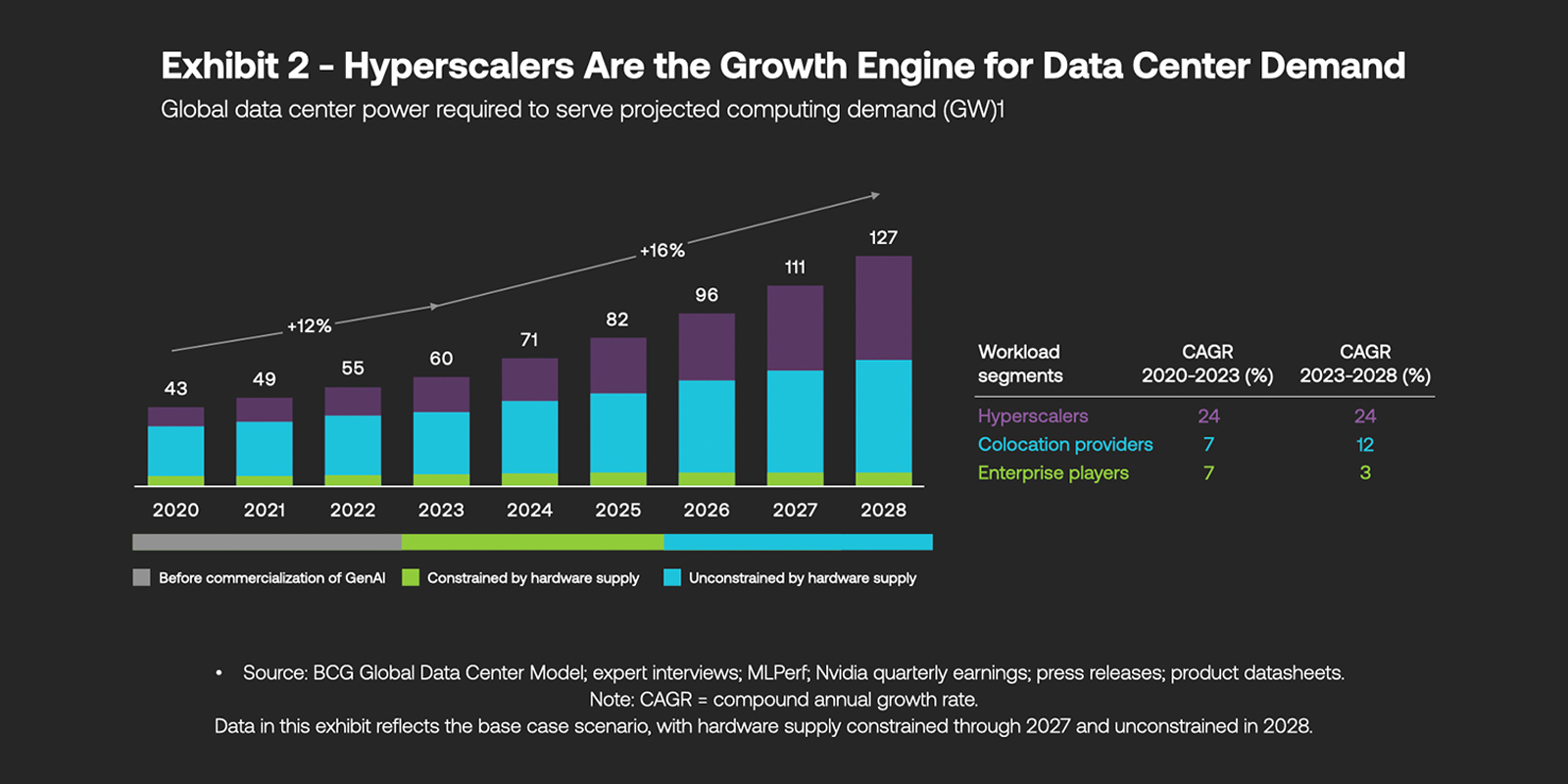

Hyperscaler data center power demand shows exponential growth trajectory, with AI workloads driving requirements from 43 GW in 2020 to projected 127 GW by 2028—a 16% annual compound growth rate. Hyperscalers represent fastest-growing segment at 24% CAGR, fundamentally outpacing traditional enterprise and colocation providers in power consumption patterns.

Cooling requirements for large-scale AI facilities introduce additional environmental considerations. Data centers optimized for AI workloads consume 30-50% more energy for cooling than traditional facilities, creating demand for innovative cooling technologies and favorable climate locations.

Investment Framework and Risk Analysis

Economic returns from successful development justify massive upfront investment despite high uncertainty and long timelines. Conservative estimates suggest capabilities could create $10-100 trillion in annual economic value once deployed, providing positive NPV for investment levels approaching $1 trillion even with high discount rates and low success probability.

OpenAI’s projected cash flow pattern through 2027 reveals the capital intensity of development. Despite growing revenues, negative free cash flow continues through 2027, with 2026 showing nearly -$20 billion burn rate. This trajectory mirrors other transformative technology developments requiring massive upfront investment before achieving sustainable profitability.

Option value embedded in research creates additional investment justification. Early technical breakthroughs, even if insufficient for full artificial general intelligence, often have valuable applications in narrower domains. Portfolio effects reduce effective risk by providing intermediate value creation opportunities.

Competitive dynamics create asymmetric payoff structures where success generates enormous returns while failure may still provide valuable IP and technical capabilities. Risk profiles attract venture capital and corporate strategic investment despite uncertainty about timelines and technical feasibility.

Current investment environment benefits from historically low interest rates, abundant venture capital, and strong public market appetite for AI-related investments. However, capital intensity and long development timelines create vulnerability to economic cycles and changing investor sentiment.

Regulatory environment remains uncertain, with potential for significant compliance costs or operational restrictions altering project economics. Companies must factor regulatory risk into investment decisions while maintaining competitive positioning in rapidly evolving landscape.

International competitive dynamics create first-mover advantages justifying aggressive investment despite uncertain returns. Potential for technological leadership to translate into sustained economic and strategic advantages provides additional rationale for current investment levels.

Strategic Implications and Policy Framework

Strategic importance creates rationale for government intervention in markets typically left to private competition. Dual-use nature of capabilities, with applications in defense, economic competitiveness, and social infrastructure, suggests purely market-based development may not align with broader national interests.

Infrastructure requirements—including semiconductor manufacturing, energy generation, and telecommunications—create opportunities for targeted industrial policy supporting private development while building strategic capabilities.

International competitive dynamics may require new forms of technology cooperation and competition management. Potential for capabilities to create permanent advantages necessitates careful consideration of technology transfer policies and alliance strategies.

Development of potentially transformative systems requires regulatory frameworks balancing innovation incentives with safety considerations. Current regulatory uncertainty creates compliance risks for developers while potentially delaying beneficial technological deployment.

Concentration among small number of companies raises antitrust considerations balanced against economies of scale required for successful development. Traditional competition policy may prove inadequate for markets with extreme fixed costs and network effects.

Safety requirements may necessitate new forms of public-private cooperation, including government involvement in testing, validation, and deployment oversight. Costs of comprehensive safety frameworks could significantly alter project economics and competitive dynamics.

Conclusion: Economics of Transformation

Building artificial general intelligence represents economic mobilization paralleling greatest industrial efforts in human history. Convergence of exponential scaling requirements, unprecedented capital intensity, and winner-takes-all dynamics creates investment patterns and market structures previously seen only during wartime mobilization or major infrastructure development.

Technical evidence suggests achieving human-level intelligence requires coordinated investment exceeding $1 trillion globally, with individual companies potentially investing $100+ billion in development programs. Economic returns from successful deployment justify these investment levels despite high technical and market risks, creating rational incentives for current corporate and national commitment levels.

Strategically, current efforts create new forms of economic and technological competition determining global power structures for decades. Countries and companies successfully navigating economics will capture disproportionate benefits, while those underinvesting risk permanent technological and economic disadvantage.

Policy implications extend beyond technology development to fundamental questions about market structure, international competition, and government roles in coordinating large-scale technological development. Economic mobilization required may necessitate new forms of public-private cooperation and international coordination managing both competitive dynamics and systemic risks.

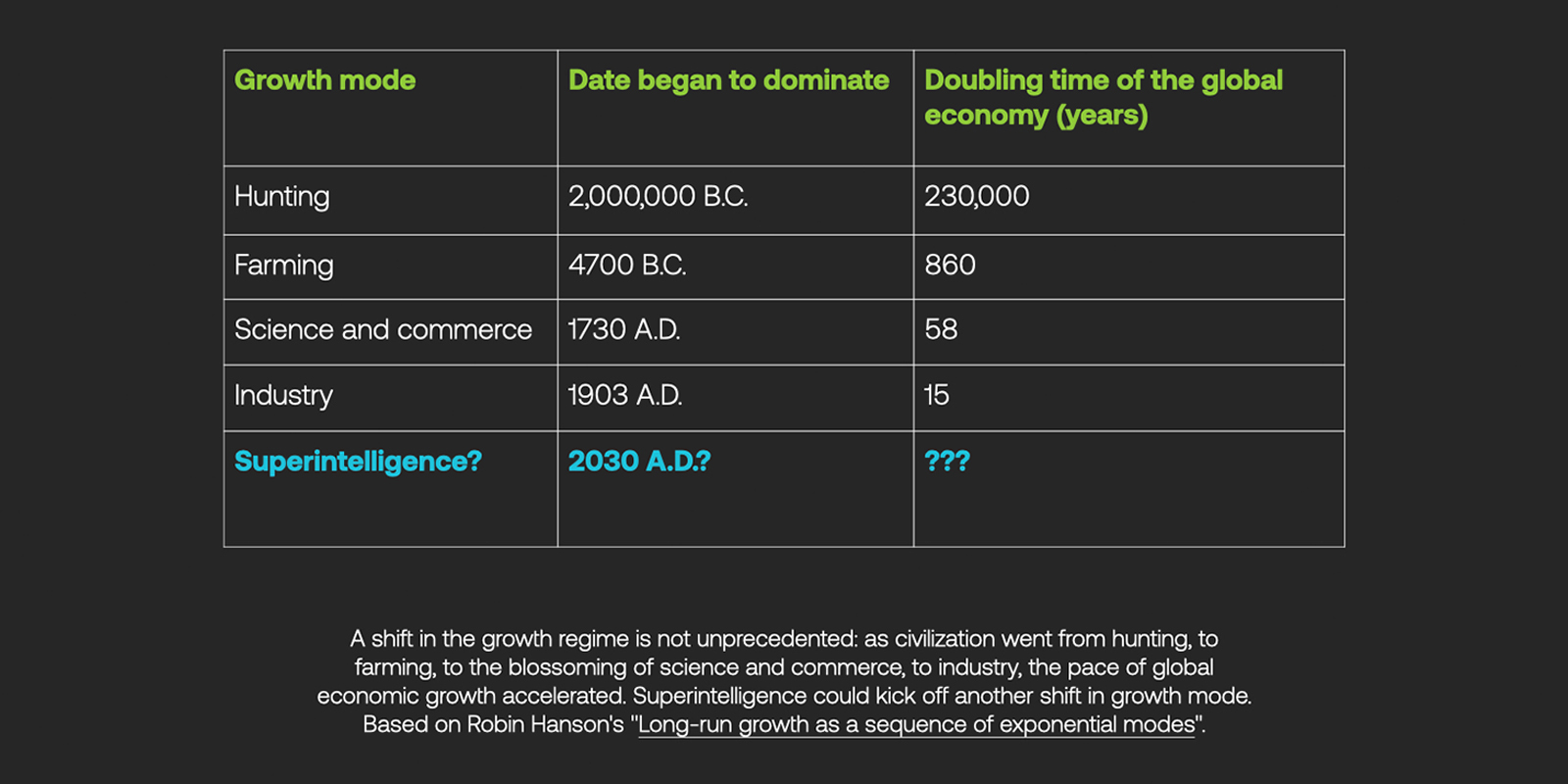

Historical growth mode transitions provide context for potential impact on civilization. Previous shifts—from hunting to farming, farming to science and commerce, and science to industry—accelerated global economic doubling times from 230,000 years to just 15 years during peak industrialization. If superintelligence emerges around 2030, it could trigger another fundamental growth regime shift, potentially reducing economic doubling times to unprecedented levels and reshaping human civilization within decades rather than centuries.

Ultimate economic impact will likely exceed current projections, with successful deployment creating productivity improvements and market opportunities justifying massive upfront investment. However, transition costs and distributional effects require careful management ensuring benefits translate into broadly shared economic prosperity rather than concentrated technological advantages.